Your Ideal Shopping Campaign: The Critical Segmentation Decision

Columnist Carrie Albright lays out the considerations for shopping campaign structure, including the pros and cons of brand, category, and product segmentation.

Although Google Shopping campaigns have officially been widespread for over a year (and Bing is catching up quickly), the fine art of structuring and optimizing Shopping campaigns is still a mystery to many.

A common first step is to simply create an “All Products” campaign to test the waters and get a few ideas for how your feed actually performs. But where to go from there is a crucial decision, and a wrong turn may create a long path of inefficient optimizations and troubled campaign management.

Before creating your first handful of campaigns, it’s imperative that you take a moment to reflect on what strategy will work best for you and your product inventory.

Consider the following factors:

- Volume of your inventory. Are we talking 50 products or 50,000 products?

- The frequency with which your inventory changes. Do you have to account for heavy seasonality, many unique or custom items, or simply just a lot of products in rotation?

- Your ability to affect your feed, such as adding new columns of data.

- Your understanding of the profit associated with the products you sell. Do you have a set of products that contribute most to your overall revenue?

- How much of your data you’d like to manage. Your entire feed? Part of your feed? Only seasonal products or newest releases? Search Engine Land Paid Media reporter Ginny Marvin provided a breakdown on the impact of focusing solely on Top Performers versus an entire inventory approach.

Once you’ve identified what products, content, and metrics are going to drive your campaigns, we can begin to consider the structures to use within the platform interface. Today, we’ll cover the following three segmentation options:

- Brands

- Categories & Types

- Product IDs

Product Brands

This is the first step many take in segmenting Shopping campaigns. If your brands are recognizable by brand name, such as Nike, Sony, or Kelty, this can be a quick and simple way to create more visibility and control within your account.

In Google Shopping, you simply create a product group based on Brand:

Pros:

The greatest benefit to this simple segmentation is improved budget allocation. Because an All Products campaign allows for spend to the products that get their clicks in first, a segmented-by-brand campaign can assist in providing the budget where it’s deserved, often with the brands that offer top sales and top return on ad spend.

The secondary benefit is the increased bidding within your campaign. Yes, you can use the beloved Dimensions tab for insight into the feed segments, but by building your campaigns with segments included, you can immediately adjust your bids as you review your data.

Cons:

If your only segment is the brand you’re including, you leave yourself open to other inefficiencies. For example, you may expand your inventory of youth athletic equipment each fall, to account for new sports seasons. If these particular products are tucked away in a campaign only segmented by the product brand, they may be stifled. If perennial products continue to use the campaign’s budget, the seasonal products may not have the opportunity to shine and sell.

Example:

Upon creating an original shopping campaign, all products were run from a single campaign (All Products) for 90 months. After 3 months, the Nike brand was broken out into its own campaign and removed from the All Products campaign. In the following 90 days, we saw a 233% lift in conversion rate compared to the performance for Nike products in the All Products campaign.

We also saw a slight decline in CTR, but the fact that we more than doubled our impression volume in 90 days at a nearly consistent rate was considered just fine. And right out of the gate, this shift experienced a 61% drop in CPA and a 116% ROAS, both of which indicate the boost in efficiency this new structure created.

Publisher Categories

Both Google and Bing offer categories, recognized as “product types,” in the product feed. Then, one can incorporate these types into segmentation within your campaigns and your Dimension data. While the Bing options are a bit more rudimentary, there is still the option to segment in this way, which helpful in improving performance.

Pros:

The benefit of using product types is that you create clean segmentation in campaigns that may not have highly recognizable brands. Not every business sells Puma or Bose or Fossil. Sometimes you have a great product whose brand is still less well known. In this case, your best option for semi-general segmentation is to use product types.

With Shopping campaigns and ad groups by product type, your structure revolves more around the type of inventory you offer. Are some of your items “big ticket” items? Do you have replacement parts or complementary items that sell, but at a lower overall revenue?

For example, below are two campaigns which feature espresso and coffee makers, and espresso and coffee accessories:

When you know that you have a subset of products that can be grouped into a hierarchy, the product type segmentation will help you keep each type running efficiently.

Cons:

The first concern with this method is simply the use of these prescribed product types. Do your products accurately fall into these categories? Depending on your inventory, you may be opening a whole new can of worms of sorting and selecting your product types. While this is not time wasted, it certainly is a chunk of time that, depending on your product count, may end up being substantial.

Additionally, as you utilize segments that focus on product types, such as men’s, women’s, boots, or hats, the implementation of exclusions becomes increasingly important. A product group that contains women’s sandals should be carefully accompanied by an exclusion of non-women’s sandals.

This keeps searches for men’s sandals from creeping into your data, causing all sorts of incorrect adjustments based on this product type.

Product ID

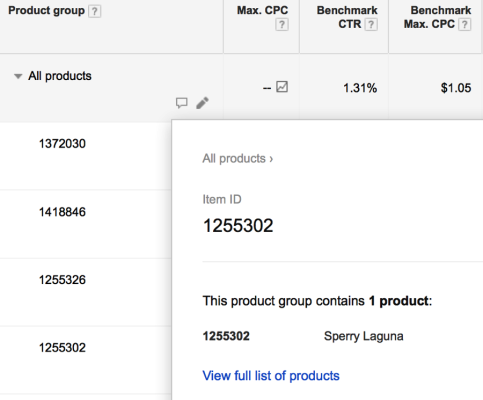

Using the Product ID field of your campaign gives you the opportunity to target down to the very specific product you’re selling. In the apparel industry, this may refer to a unique size and color of shirt. In the homewares industry, it may be a glass carafe replacement for a French press.

Pros:

In the event of a feed that doesn’t have a lot of consistent brands, or doesn’t segment into many different product types, segmenting by product ID may be your best choice. It allows you to include a set of products and target them individually for the best return.

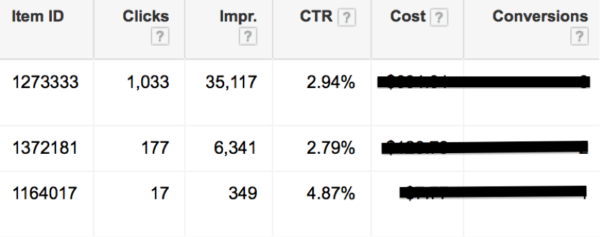

Product IDs also allows you to pinpoint those products that are particularly successful. In your broader campaigns, such as Product Brand Shopping campaign, you may find through an ID report, like the one below, that a set of products have performed consistently well.

From the above list, we can make a campaign targeting our top performing products to ensure they receive the entire budget and bid attention they need.

Not only can we, but we actually did.

Example:

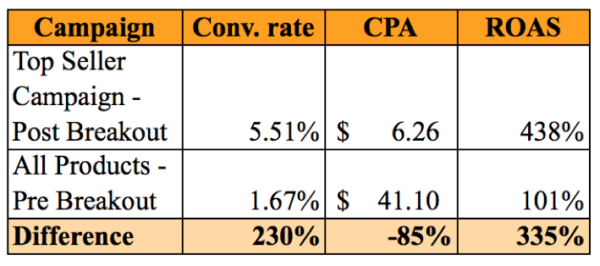

We identified the top selling products and gave them their very own campaign:

After 90 days of basic optimizations, we took a look back at how the All Products campaign performed and then how the Top Sellers compare. And the results were pretty much what we thought we’d see in a 90 Day comparison:

Conversion rate was 2.3x higher immediately upon breaking out our top performers. Cost per sale saw a drastic drop, noting the fact that when top selling products are simply lumped into broader campaigns the overall CPA was running inefficiently. The All Products also saw a bit of improvement as we continued to pull out clear performers. In the 90 days after the Top Sellers were launched at full speed, All Product CPA decreased by another 40% and conversion rate increased by 33%.

Cons:

The “cons” of this strategy is plain and simple: When you’re working from specific product IDs, you suddenly have a lot of product lists to keep track of. Depending on the volume in your inventory, this task may quickly spiral out of control. Although segmentation and customization are vital to create an efficient account, it’s also imperative that you take a moment to consider the impact of what you’re doing.

Breaking out 15,000 products by individual IDs, attempting to keep them fitted with appropriate budgets, and reviewing all those delicious segments like dayparting and geotargeting is a near impossibility.

Similarly, if your product inventory changes regularly, you will be constantly chasing the tail of your Shopping campaigns. As your understanding of your product performance advances, there are even more ways you can arrange your Shopping campaigns for improved efficiency and increased revenue.

The Big Picture

After reviewing these various breakdowns, you should have an idea of what will be your most successful strategy. Shopping campaigns depend on many factors for success: Maintenance is a big one, but structure is even greater. By finding the right structure for your business and your inventory, you’ll find that managing and succeeding Shopping campaigns is easier than you think!

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land