6 Holiday Trend Shifts That Heavily Impact SEM

Anyone involved with online retail should be well aware of just how critical holiday revenues are, not only to a strong fourth quarter, but to our success for the entire year. An RKG analysis of 2011 paid-search results shows that, on average, retailers generated 18% of their annual revenues over the 30 day period starting […]

Anyone involved with online retail should be well aware of just how critical holiday revenues are, not only to a strong fourth quarter, but to our success for the entire year. An RKG analysis of 2011 paid-search results shows that, on average, retailers generated 18% of their annual revenues over the 30 day period starting with Thanksgiving Day, with daily sales volume coming in at nearly triple the rate of the rest of the year.

But, revenue volume isn’t the only metric that shifts significantly during the holiday season, and as we’ll see below, the assumptions and strategies that serve us well for the rest of the year just won’t cut it as we navigate through the holiday peak.

Here are six of the most critical ways historical paid-search trends shift as we hit the holidays:

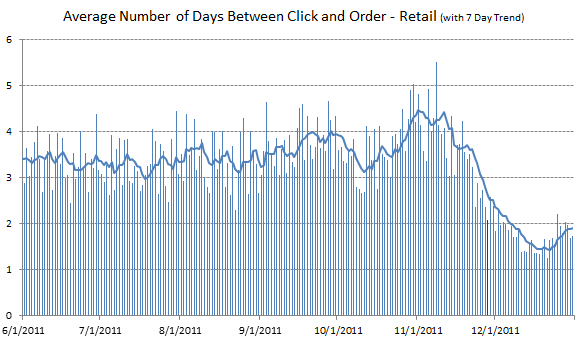

Shift #1: Click To Order Latency Swings Dramatically

For most of the year, the average latency between a paid-search click and order is pretty stable at around 3.5 days. As we move into early to mid-November, though, we see that latency rises and peaks at roughly 4.5 days.

This reflects the growing number of shoppers who have begun the research process, but will ultimately make their purchases over the course of the next few weeks — many of them timed to the heavy promotions on Black Friday and Cyber Monday.

Note that here and elsewhere in this analysis, unless otherwise specified, we are associating orders with the day of the clicks that generated them, not the day of the orders themselves. This is an important distinction and one we’ll examine in detail below.

Thanksgiving highlighted orange; Cyber Monday red

As we hit Thanksgiving and subsequently those two big promo days, average click-to-order latency begins to fall precipitously. Consumers no longer have an incentive to wait for promotions to kick in and are facing an approaching deadline.

Latency eventually reaches a nadir about a week before Christmas, which is roughly when we hit ground shipping cutoffs. In 2011, the day with the shortest click-to-order window was December 20th. At that point, Christmas shoppers could still place orders with 2-day or overnight shipping and not have to fight the in-store crowds or disappoint their loved ones with hastily prepared homemade gifts.

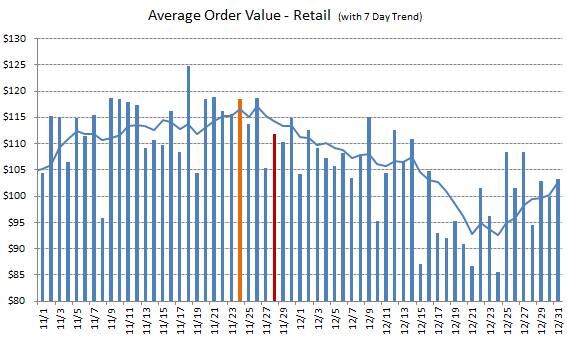

Shift #2: Average Order Value Falls Off

As holiday shoppers get down to the wire, they also begin to spend less and less per order. In 2011, the largest holiday season orders occurred the week of Thanksgiving, with an average-order-value between $115 and $120. By mid-December, AOVs fell to between $90-95, with a low of $86 on December 24th.

These AOV trends likely reflect a combination of factors:

- First, the mix of non-gift and gift orders should shift from the former to the latter as we move beyond Thanksgiving, showing that shoppers are willing to spend more on themselves than others.

- Gift shoppers that purchase prior to the big promotions around Thanksgiving are likely less price-sensitive.

- The promotions themselves, often heavy price markdowns or a percentage off, can directly drive down average order size.

- Gifts bought at the last minute are more likely to be for people the buyer is not as close to, and therefore the buyer may be inclined to spend less.

There’s also a bit of a chicken and egg situation here as retailers, recognizing some of these factors, choose to highlight items they believe are more likely to be bought as gifts, and these items often have a lower-than-average price point.

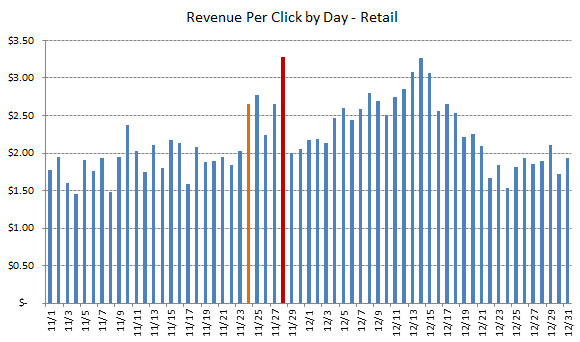

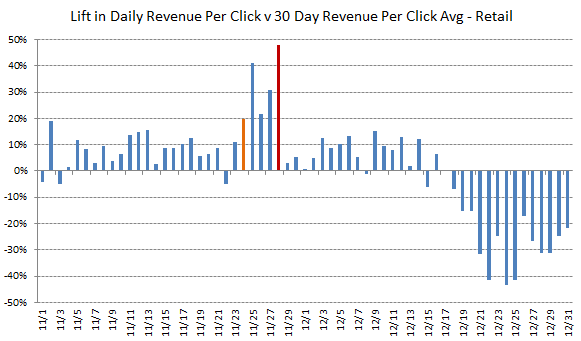

Shift #3: Revenue Per Click Skyrockets

Despite decreasing order sizes, average revenue-per-click (RPC) increases sharply over the holiday buying season on the strength of higher conversion rates. On Thanksgiving last year, RPC jumped about 30% over the day before, which had been a pretty typical mid-November day in terms of RPC.

A few days later, we saw a higher peak on Cyber Monday, followed by a drop-off to just above pre-Thanksgiving levels. We then saw steady growth to another peak in mid-December.

While for much of the calendar year, the average performance of the previous 30 days will give us a reasonably close estimate of our actual revenue per click today, the dramatic increases in RPC during the holidays nullifies this connection.

For example, revenue-per-click on Cyber Monday in 2011 was nearly 50% higher than the average over the previous 30 days. Had a retailer been determining their bids by a 30-day average, or even one based on a shorter time window, they would have missed out on a great deal of profitable traffic.

On the flip-side, once we hit shipping cut-offs and revenue-per-click begins to subside, the 30-day average view of revenue-per-click will be overly optimistic and suggest bids that are too high. This scenario will carry over right through the early days of the new year.

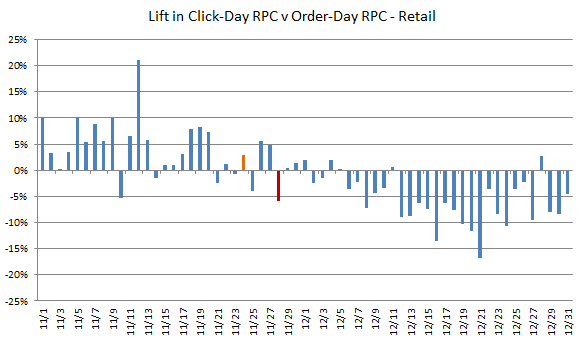

Shift #4: Divergence Of Revenue Tied To The Click Day vs. Order Day

Similarly, how we tie clicks and revenue together in our bidding assumptions becomes more critical as we enter the holiday season. Because of the latency effects mentioned earlier, many of the orders that occur on any single day were actually generated by a click that occurred on an earlier date.

If we want to know what our bid should be on a given date, we need to predict the full value of the clicks on that date over the long-term — we can call this the click-day revenue per click.

It’s more common, however, to calculate revenue-per-click for any given day based on all of the clicks and orders that occurred on the same day, even if we know some of those orders were generated by earlier clicks — we can call this our order-day revenue per click.

Unfortunately, as latency shifts significantly, as it does during the holidays, the simpler order-day calculation can become quite inaccurate as a proxy for click-day RPC and lead to poor bids that undervalue early season clicks and overvalue late season clicks.

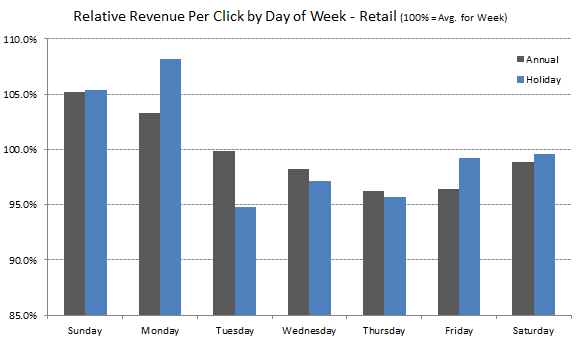

Shift #5: Normal Day-Of-Week Trends Fall Apart

Given what we’ve seen so far, it is little surprise that historical intra-week performance patterns become less predictive during the holiday season. While there are atypical days throughout the year, often tied to other holidays and/or promotions, the holiday season has a number of incongruous days within a short period.

At the same time, revenue-per-click is either rising or falling sharply in general, depending on where we are in the season.

Comparing day of week revenue-per-click differentials for the holiday season to the rest of the year may not look like there are dramatic differences — Mondays during the holidays look particularly strong compared to the rest of week, but otherwise, the trends appear fairly similar. But, applying weekparting bid adjustments during the holidays in the same manner we might throughout the year can lead to big mistakes.

On Cyber Monday, for example, our annual day-of-week trends in 2011 would suggest revenue-per-click would be down about 2% from the day before. Our holiday-season averages would suggest a lift of 3% from Sunday. In fact, revenue-per-click jumped 23% from Sunday to Cyber Monday.

A couple weeks later, on Tuesday, December 13th, as RPC approached its peak for the season, revenue-per-click was up 8% from the day before, even though our average result for the season would suggest a 12% decline was due. These are not cherry-picked anomalies, but common and predictable results within the larger holiday picture.

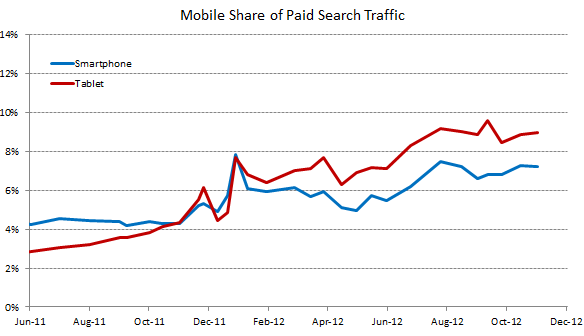

Shift #6: Mobile Traffic Patterns Fluctuate More Erratically

It’s no secret that mobile search has grown rapidly over the last couple of years, but that growth has come in fits and starts, often around major device releases, but particularly during the holidays when a lot of devices are being purchased and shoppers are out and about.

Last year, we saw a surge in mobile’s share of paid search traffic in late November, right around the key Black Friday weekend. Mobile generated nearly 12% of clicks at that time, up from 9% just a few weeks earlier.

This year, when shoppers are again hitting up brick and mortar stores in droves, we should expect a repeat of last year’s mobile surge, only with higher stakes. As of early November, RKG pegs mobile share at about 16%. If we see results similar to last year, we could see spikes to a quarter to a third of traffic.

This marks both a challenge and an opportunity for online retailers. Assessing the full value of smartphone traffic remains a significant hurdle, but brick and mortar retailers will need to steer the mobile audience to both their online and offline locations, while pure-plays will have to convince that same audience to go home and buy online, or better yet, buy right then and there on their devices.

But, the issues with tracking all of this activity could make paid search performance appear worse than it really is, especially on those mobile-heavy days. Advertisers should keep an eye on the relative shares of mobile and desktop and not overreact to issues of quantification rather than performance.

Conclusion

With so much riding on such a compressed time-table, our margin for error during the holidays shrinks considerably, and we cannot assume that what works for us during the rest of the year will work for us in November and December. Consumer behavior during the holiday season is unlike that of any other period, and it can change on a dime around critical events like Black Friday and ground shipping cutoffs.

The more accurately advertisers can predict holiday shopping behavior, the better we can prepare and anticipate the changes we will need to make to our paid search programs. Most of the points addressed here are of particular importance to bidding, and retailers should be cautious about being overly reliant on a black box algorithm unless they are certain it is accurately taking into account the insights that savvy marketers can bring to the table.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land